Expanding your UK business into Australia offers great opportunities, but navigating payroll compliance is challenging. With complex awards, superannuation rules, and strict ATO reporting, local expertise is essential.

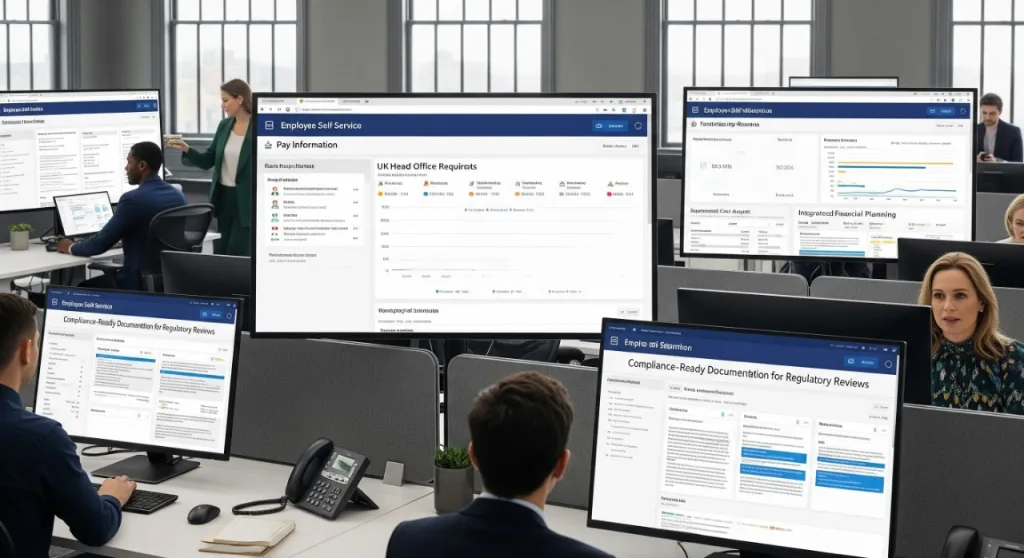

International Commercial Services provides Payroll Outsourcing for UK businesses in Australia, ensuring compliance, efficiency, and audit readiness while you focus on growth.

For UK businesses in Australia, Australian payroll outsourcing means partnering with local specialists to manage all payroll tasks. This encompasses precise wage computations in line with Australian industrial awards, as well as managing taxation, superannuation, and regulatory compliance.

To operate legally, UK businesses must adhere to Australian payroll legislation concerning:

Non-compliance can lead to hefty penalties, putting your Australian expansion at serious risk.

UK businesses expanding into Australia face payroll complexities such as:

Our local payroll experts will ensure your compliance, reduce risk, and simplify your expansion journey from day one.

Expanding from the UK to Australia means dealing with two very different payroll frameworks. At ICS, we bridge that gap—helping UK businesses navigate Australia’s complex payroll landscape with confidence.

Our team combines in-depth knowledge of Australian employment laws, Fair Work standards, and award interpretation with seamless payroll software integration, ensuring your staff are paid accurately and compliantly every time.

Think of us as an extension of your UK team—on the ground in Australia and ready to support your success.

Australian payroll is significantly more complex than UK PAYE systems, involving intricate obligations and state-based variations. Outsourcing ensures compliance while allowing your UK team to focus on core business activities without needing to master Australian employment law.

Yes, absolutely. Payroll outsourcing is great for small UK businesses starting in Australia because it saves time, avoids the need to hire local payroll staff or buy complex software, and ensures you’re fully compliant with Australian payroll rules right from the start.

We provide payroll reports in both AUD and GBP, including currency conversions, making it easy to match your UK accounting and parent company reporting requirements.

If laws change, we update your payroll automatically to ensure compliance. You’ll be notified in advance, so your business in Australia runs smoothly without surprises.

We can onboard your Australian employees within 1–2 weeks, handling everything from data transfer to tax and super setup, with little to no disruption to your UK operations.

Yes, we manage workers’ compensation and payroll tax for all Australian states and territories, making it easier for UK businesses to stay compliant with Australia’s different state rules.

Yes, our team specialises in Australian awards, enterprise agreements, and penalty rate calculations, including weekend loadings, public holiday pay, shift allowances, and overtime rates that are unique to the Australian employment system.

We provide dual reporting formats—detailed Australian compliance reports for local requirements and consolidated summaries suitable for UK parent company financial reporting, ensuring you meet obligations in both jurisdictions.

Expanding your UK business into Australia just got easier. With International Commercial Services, you gain a trusted local partner who makes Australian payroll effortless, accurate, and fully compliant for UK businesses.

Contact us today for a free consultation and fixed-fee payroll quote tailored to your UK-to-Australia expansion plans.